The U.S.-China trade war between 2018 and 2019 offers a fascinating case study in negotiation strategy — or, in many respects, a lack thereof. Examining the escalation of tariffs under the Trump administration and China's calculated responses offers valuable lessons when compared to established negotiation frameworks, such as "Getting to Yes" by Roger Fisher and William Ury and "Never Split the Difference" by Chris Voss. 📈

Negotiation Situation Overview 🧰

President Trump initiated tariffs on Chinese goods, increasing rates progressively from 34% to 84% and ultimately to 145%. Initially, China refrained from responding, but eventually matched the tariffs in a tit-for-tat manner. Trump publicly called for a dialogue with President Xi, expressing readiness to "make a deal." China remained unmoved. Ultimately, Trump rolled back some tariffs without securing significant concessions.

Comparative Analysis: Key Negotiation Techniques 🧵

1. Getting to Yes: Principles-Based Negotiation 📄

Separate the people from the problem 👥🔧: Trump's negotiation personalized the trade conflict, often publicly challenging Chinese leadership, which likely entrenched opposition rather than fostering cooperation.

Focus on interests, not positions 🔄: Trump's escalation fixated on "winning" or imposing tariffs rather than clarifying underlying interests, such as intellectual property protection or market access.

Generate options for mutual gain 📊: The strategy lacked collaborative solution-building, relying instead on threats and escalation without offering mutual benefits.

Insist on objective criteria 📝: The tariff decisions appeared impulsive rather than grounded in neutral standards or transparent economic goals.

2. Never Split the Difference: Tactical Empathy and Emotional Control 🔍📊

Tactical Empathy 👨👨👦: Trump's public moves showed little tactical Empathy. He failed to acknowledge China's domestic political pressures and economic concerns, which are crucial for influencing their behavior.

Controlled Emotionality 😐: The public "call me" moments reflected emotional urgency, which weakened perceived bargaining power. Chris Voss emphasizes appearing calm and indifferent to outcomes to maintain control.

Calibrated Questions 🔠: Instead of asking "how" questions to engage China in solving mutual problems, Trump's Approach dictated terms and demanded compliance, limiting dialogue.

No Deal is Better than a Bad Deal ❌: Trump's tariff rollback, without securing significant concessions, suggests a deviation from this principle.

Where the Strategy Diverged from Best Practices 📉

Trump's Approach leaned heavily on "power negotiation" — using economic pressure to extract concessions — but neglected the equally critical relational and procedural aspects emphasized by Fisher, Ury, and Voss. By revealing its urgency and inconsistency, the Trump administration reduced its leverage over time. In contrast, China's calculated patience exemplified control, focus on interests, and tactical silence. 💪

Forward-Looking Lessons 🔬

Negotiators today can extract powerful lessons:

📐 St a communicated "why" to provide purpose and credibility.

🔄 Focus negotiations on interests, not emotions or optics.

🤝 Apply tactical Empathy to understand the pressures your counterpart is facing.

🤦 Maintain emotional control to avoid signaling desperation.

📋 Prefer no deal over a poorly constructed agreement.

By marrying principled negotiation (“Getting to Yes”) 🔄 with tactical negotiation ("Never Split the Difference") 🔬, leaders can negotiate more effectively, securing results that are durable, fair, and strategically sound. 🌟

Sources: 📃

Fisher, R., Ury, W., & Patton, B. (2011). Getting to Yes: Negotiating Agreement Without Giving In. Penguin Books.

Voss, C., & Raz, T. (2016). Never Split the Difference: Negotiating As If Your Life Depended On It. Harper Business.

McKinsey Global Institute (2019). "Globalization in Transition: The Future of Trade and Value Chains." Link

Goldman Sachs Research (2019). "Trade War Escalation: Macro Impact." Link

."It's a bad time to start a startup."

That sentiment echoes loudly in today's turbulent macroeconomic environment. 📉 With rising interest rates, capital market volatility, and tighter venture capital funding, many founders are hesitating. But history tells a different story—a story where some of the most iconic companies were born in crises, not booms. 💡

Let's reframe the situation.

The Power of Adversity 💥

Economic downturns create scarcity of capital, confidence, and certainty. At first glance, these might seem like startup kryptonite. But scarcity also sharpens focus, reveals real pain points, and separates vitamins from painkillers. In the absence of frothy optimism, startups are forced to:

💪 Build lean and efficient

🎯 Solve urgent, validated problems

🧠 Hire high-quality talent more affordably

💵 Focus on monetization and sustainability from day one

The Macroeconomic Context: Crises as Founding Grounds 📊

To better understand why these periods were fertile for Innovation, let’s look at the macroeconomic context during the years these iconic companies launched:

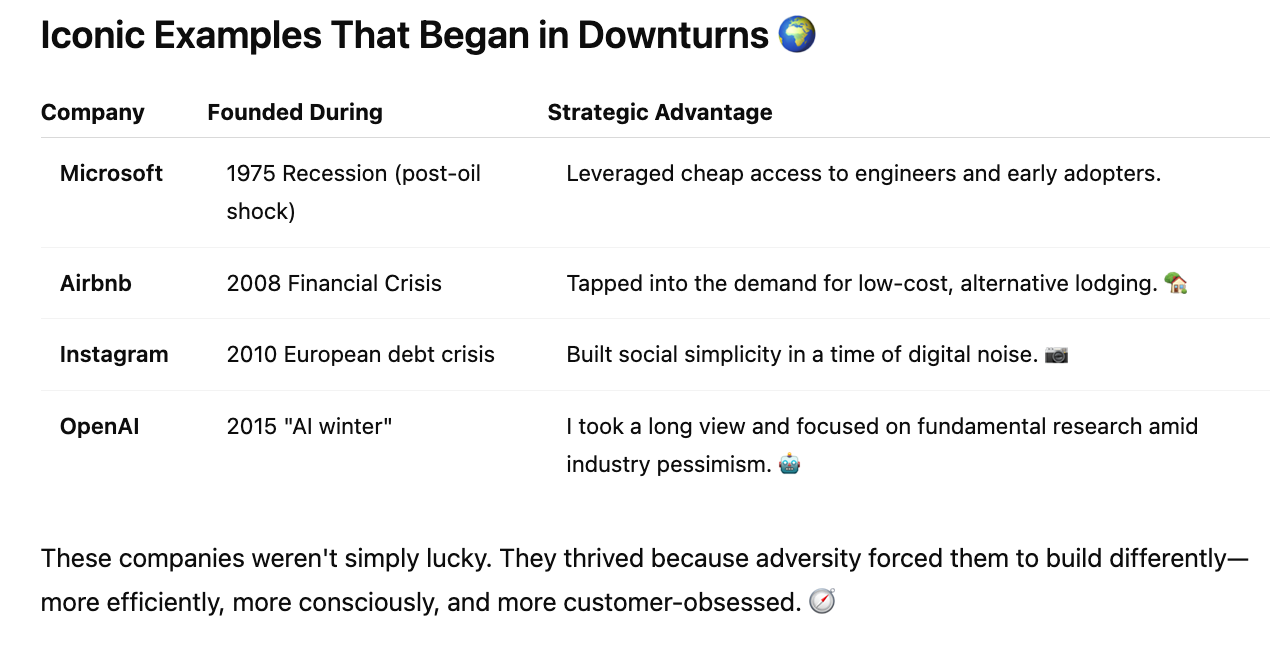

1975 (Microsoft): The U.S. was emerging from the 1973 oil crisis and experiencing stagflation. Inflation peaked at 9.1%, and GDP growth was -0.2% in 1974 (World Bank). Unemployment exceeded 8%. Yet the emerging personal computer industry offered new demand channels and nascent markets. 🖥️

2008 (Airbnb): The global financial crisis was in full swing. The S&P 500 dropped by 38.5%, U.S. GDP contracted by -2.6%, and unemployment surged to 10% (Bureau of Economic Analysis, IMF). Consumer behavior shifted radically, embracing budget-conscious options—a perfect storm for Airbnb's affordable, shared-economy model. 🌪️

2010 (Instagram): Although the crisis had technically passed, the aftermath of the European sovereign debt crisis and the U.S. jobless recovery created persistent uncertainty. Youth unemployment in Spain reached over 40%, and U.S. GDP grew sluggishly by 2.5%. Consumers turned to escapism and simplicity, fueling Instagram's rapid adoption. 🌐

2015 (OpenAI): The so-called "AI winter" continued from skepticism in academic and investor circles. Despite overall economic growth (U.S. GDP growth at 2.9%, unemployment at 5.3%), funding for AI ventures was low compared to later years. OpenAI was formed during a contrarian moment, prioritizing long-term research over hype cycles. 🧠

The Evidence: Startups Born in Crisis Perform Better 📈

According to a 2023 BCG study ("Navigating the Downturn: Building Resilient Startups" ):

Over 50% of Fortune 500 firms were founded during a recession or bear market. 🏢

Startups founded in downturns raise 35% less capital but are 3x more likely to reach profitability by Series C. 💸

They also experience lower founder burnout due to a clearer focus and better alignment with real market needs. 🧘

Crunchbase adds that post-recession startups outperform in long-term value creation, particularly in enterprise software, fintech, and AI-driven platforms. 🧬

Why Now Might Be the Perfect Moment ⏳

Today, we face another moment of economic recalibration:

💼 Venture capital has become more selective

📈 The cost of capital has increased (U.S. Fed Funds Rate at 5.25% as of 2024)

🧭 Consumers and businesses are rethinking priorities

Yet these are precisely the forces that help great startups rise. The field is less crowded. The noise is reduced. And survival requires solving real problems. 🔍

What Founders Should Do Now 💼

Solve problems that matter: Downturns elevate pain points that people must pay to fix. 🩹

Start lean and iterate fast: Scarcity forces discipline—embrace it. 🛠️

Surround yourself with committed talent: Layoffs and corporate slowdowns make exceptional talent available. 👥

Plan for early monetization: Build models that work without relying on endless VC rounds. 💰

Closing Thought 🌟

The best startups aren't just founded during good times. They are forged during bad times. 🔨

In the words of investor and entrepreneur Paul Graham:

"You can’t wait for the perfect time. It doesn’t exist. The best founders create in any weather."

So if you're thinking of starting up now, ignore the fear. History is on your side. 📜💼

Sources:

BCG (2023). "Navigating the Downturn: Building Resilient Startups." https://www.bcg.com/publications/2023/building-resilient-startups-in-a-downturn

Crunchbase (2023). "The Resilient Startup: Founding in a Bear Market." https://news.crunchbase.com/startups/startups-downturn-recession-funding/

McKinsey (2023). "A new era for Innovation ecosystems." https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/a-new-era-for-innovation-ecosystems

World Bank Open Data: https://data.worldbank.org

U.S. Bureau of Economic Analysis: https://www.bea.gov

IMF World Economic Outlook (2023): https://www.imf.org/en/Publications/WEO

Nasdaq, Yahoo Finance, Statista, PitchBook (2024 valuations)