Strategic Dependencies and Economic Realignment: Egypt's Foreign Bailout and Its Long-Term Macroeconomic Implications

Executive Summary 📊

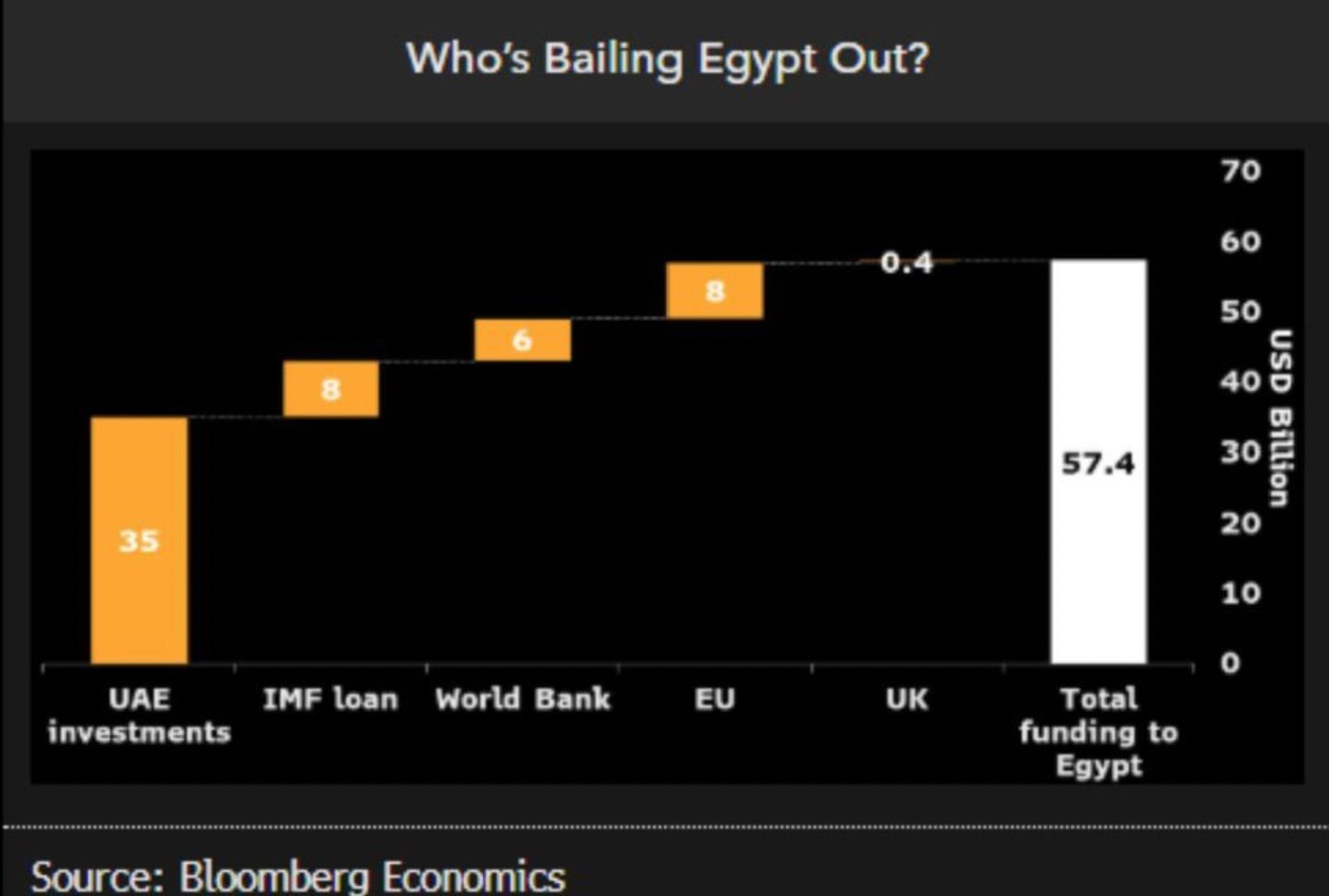

Egypt has secured approximately USD 57.4 billion in external funding, primarily from the UAE (USD 35 billion), the IMF (USD 8 billion), the World Bank (USD 6 billion), the EU (USD 8 billion), and the UK (USD 0.4 billion). This capital injection is aimed at stabilizing a deeply distressed economy, which is facing high inflation, currency devaluation, and external debt pressures. While the funding provides short-term relief, it sets the stage for long-term structural shifts in Egypt's geopolitical alignment, economic policy direction, and institutional reforms.

1. Situation Analysis ⚠️

Egypt is undergoing one of its most profound macroeconomic crises in decades, driven by a convergence of domestic mismanagement and global shocks:

📈 Rising inflation: Surpassing 30% YoY, inflation is eroding consumer purchasing power and increasing the cost of living for millions.

💸 Currency devaluation: The Egyptian pound has lost over half of its value since 2022, making imports less affordable and eroding the country's reserves.

🏛️ Surging debt levels: External debt now exceeds 90% of GDP, pressuring Egypt’s fiscal flexibility.

📉 Twin deficits: Both the current account and fiscal deficits have widened, limiting the government’s ability to respond without external aid.

2. Source and Composition of External Aid 🌐

Egypt’s external financing is not only diverse in source but also in intent and conditionality:

🇦🇪 UAE (USD 35B): Largest contributor, via direct investments likely tied to state asset purchases and infrastructure development.

🌍 IMF (USD 8B): Extended Fund Facility structured with deep macroeconomic reforms, including liberalization and subsidy rationalization.

🌎 World Bank (USD 6B) + 🇪🇺 EU (USD 8B): Primarily focused on social spending, climate resilience, and governance reforms.

🇬🇧 UK (USD 0.4B): Symbolic involvement with limited financial leverage.

3. Strategic Implications 🔍

a. Geopolitical Alignment 🌏

Egypt’s geopolitical posture is increasingly influenced by the Gulf, particularly the United Arab Emirates (UAE). The volume of capital invested gives the UAE significant soft power over its domestic policies, particularly in areas such as privatization and economic liberalization. Multilateral involvement ensures a level of accountability but signals a multipolar influence on Egypt’s financial trajectory.

b. Sovereignty and Economic Independence 🏛️

Selling state-owned enterprises and strategic infrastructure to foreign investors may solve short-term liquidity issues, but it risks compromising long-term economic sovereignty. Public backlash is possible if citizens perceive a loss of national assets to foreign control without tangible domestic benefits.

c. Fiscal and Structural Reform Trajectory 🧩

The IMF’s program includes demanding reforms, such as exchange rate liberalization, public sector downsizing, and cuts to energy subsidies. These are essential for long-term stability, but they are politically sensitive. Delays or partial implementation could jeopardize future funding tranches.

4. Long-Term Economic Consequences 📉📈

a. Debt Sustainability 💰

While the bailout addresses short-term liquidity, Egypt’s external debt profile is now more fragile. Without robust export growth or FDI inflows, Egypt could face refinancing risks within the next 5–7 years.

b. Investment and Growth Outlook 📊

The crisis presents a structural pivot point. If reforms are implemented and investor confidence restored, Egypt could achieve 4–5% annual GDP growth. However, policy uncertainty or political instability could entrench stagflation.

c. Institutional Strengthening 🏗️

Donor conditions offer an opportunity to overhaul public administration, reduce corruption, and improve transparency. Yet, real progress depends on local political will and the enforcement of accountability mechanisms.

d. Currency and Inflation Management 💹

Liberalizing the exchange rate can boost competitiveness and attract capital, but may exacerbate inflation in the short term. The Central Bank will need to maintain credibility and adopt credible inflation targeting to ensure macro stability.

5. Recommendations 💡

For Egypt:

📣 Transparent reform communication: Proactively explain the rationale behind reforms and social protections to build public support and mitigate unrest.

🧮 Smart sequencing of reforms: Gradual rollout of painful measures (e.g., subsidy cuts) while enhancing safety nets to protect vulnerable citizens.

🏗️ Strategic use of Gulf capital: Channel foreign investments into sectors that drive exports and productivity, not just fiscal patchwork.

For Donors and Investors:

👀 Robust monitoring mechanisms: Insist on KPIs and progress tracking for privatization, governance, and social program effectiveness.

🛠️ Capacity building: Complement financial support with advisory and technical expertise to improve Egypt’s public sector delivery.

6. Conclusion ✅

Egypt's bailout structure provides short-term macroeconomic stabilization but initiates a critical inflection point. Its success depends on the coherent implementation of reform, transparent governance, and the ability to align geopolitical interests with long-term national development priorities.

Source: Bloomberg Economics

https://www.bloomberg.com